DST Real Estate In-Depth Guide to Delaware Statutory Trust Investing

DST real estate represents an evolving approach for investors to own fractional interests in high-quality properties without hands-on management. Through Delaware Statutory Trusts (DSTs), many real estate investors access institutional-grade assets, leverage tax-deferred structures like 1031 exchanges, and benefit from professional oversight. In this article, we dive deeply into the mechanics, advantages, technology integration, real-world examples, use cases, and risks of DST real estate, giving you a comprehensive understanding you can act on.

What Is DST Real Estate and Why Does It Matter

DST stands for Delaware Statutory Trust, a legal entity created under Delaware statute that holds title to real property or real estate assets. In a DST real estate arrangement, investors purchase beneficial interests in the trust. The trust itself owns the property; investors benefit proportionally from income, tax attributes, and appreciation.

One of the primary appeals of DST real estate is that, under certain conditions, these interests qualify as “like-kind” replacement property under IRS Section 1031 exchange rules. In practical terms, an investor selling a property can reinvest proceeds into DST interests and defer capital gains taxes so long as IRS requirements are met (timing, identification, structure). This makes DST real estate particularly attractive to property owners seeking a passive, tax-efficient transition from active real estate management.

DST real estate allows investors to access large, institutional assets multifamily housing, warehouses, net lease retail, medical offices, and more, without the burden of property management, leasing, or capital expenditure decisions. The DST sponsor or trustee handles operations, leasing, maintenance, and compliance, while investors receive cash distributions and tax advantages.

Because DST real estate is structured as a trust, it’s treated as a separate legal entity. Creditors of individual beneficial owners cannot seize trust assets, and debt incurred by the DST is nonrecourse to the investors. The structure thus promotes liability protection and alignment with real estate investment objectives.

Structure, Tax Treatment & Key Mechanics of DST Real Estate

To understand DST real estate at a deep level, one must examine its structural and tax underpinnings.

A DST is governed by a trust agreement (also called the declaration of trust) that delineates the rights and limitations of trustees and beneficial owners. That trust agreement typically restricts active decision-making by beneficiaries, limiting them to passive investors. Once capital is raised and property is acquired, the sponsor cannot add more investors or raise new capital; the structure is locked in.

For tax purposes, DST interests are often treated as grantor trusts or pass-through entities, meaning that taxable income, deductions, depreciation, and cash flows flow through to beneficial owners directly. Importantly, a 2004 IRS Revenue Ruling clarified that properly structured DST interests can qualify as replacement property in a 1031 exchange, subject to certain restrictions (such as prohibition on renegotiating debt, reinvestment restrictions, limited capital expenditure allowances, etc.).

Under that ruling, the trustee cannot renegotiate existing loans, cannot reinvest proceeds from sales, and must distribute substantially all cash to investors. These limitations ensure the DST remains a passive vehicle and preserves its compatibility with 1031 rules.

Another structural characteristic is that DSTs usually carry nonrecourse debt, limiting investor exposure. Investors are only liable up to their invested capital, not for the DST’s debt. Because the trust is a distinct legal entity, creditors cannot access individual owners’ assets.

DSTs often impose minimum investments, commonly $100,000 or more, making them typically accessible to accredited investors. The offering period is limited, and once closed, no further capital inflows are allowed. Investors generally commit to a long-horizon hold (7–10 years or more) until the sponsor executes an exit event, often a property sale.

DST real estate also must adhere to prefixed distributions, sponsor fees, property management obligations, and periodic investor reporting. Investors rely heavily on the sponsor’s underwriting, decision-making, and alignment of interests given their passive role.

Technology and Innovation in DST Real Estate

Although DST investors are passive, the operational backbone of DST real estate increasingly depends on technology for efficiency, transparency, and performance.

Modern DSTs use property management platforms and integrated digital systems to oversee leasing, track rent collections, monitor expenses, and coordinate maintenance. This ensures consistent operations across large portfolios and supports centralized oversight of multiple assets.

DST properties may integrate smart building systems and IoT sensors, particularly in industrial, office, or medical assets. These systems monitor HVAC performance, energy usage, lighting efficiency, occupancy patterns, and facility health. Such data-driven insight enables predictive maintenance, cost optimization, and better capital planning.

For investor experience, online portals and dashboards let beneficial owners view trust performance metrics, distribution history, property-level data, and tax documentation. This transparency builds trust and enables more informed expectations.

Sponsors often use analytics and market intelligence tools to assess market trends, forecast demand, identify underperforming assets, and optimize leasing strategies. By modeling rent growth, vacancy risk, and exit scenarios, sponsors can adjust strategy proactively.

In sum, technology elevates DST real estate from passive structures into data-enabled, efficient, and transparent investment platforms benefiting both sponsors and investors.

Real-World Examples & Use Cases of DST Real Estate

Below are illustrative examples of DST real estate offerings (or typical asset types) and how they operate in practice for investors. Each one shows how DST real estate can align with real-world investment goals.

1. Multifamily Apartment DST in Sunbelt Market

A sponsor acquires a portfolio of several residential apartment complexes in a region such as Florida or Texas, where population growth and housing demand remain strong. The DST bundles these properties, achieves scale, and offers a diversified portfolio within one trust. Distributions derive from net rental income, while property appreciation is realized at exit. The sponsor handles tenant turnover, capital repairs, and rent optimization. Investors benefit from stable cash flow in a sector historically resilient through economic cycles.

2. Industrial / Logistics DST near Transportation Hubs

Given the rise of e-commerce, DSTs focused on warehouses, distribution centers, and logistics real estate are especially compelling. In this example, the DST owns a modern fulfillment center leased to a logistics provider under a long-term lease. The property is strategically placed near highways or ports to maximize accessibility. Investors receive regular income from lease payments, enjoy inflation-linked rent escalations, and rely on the sponsor’s execution of capital expenditures like roof repairs or dock upgrades.

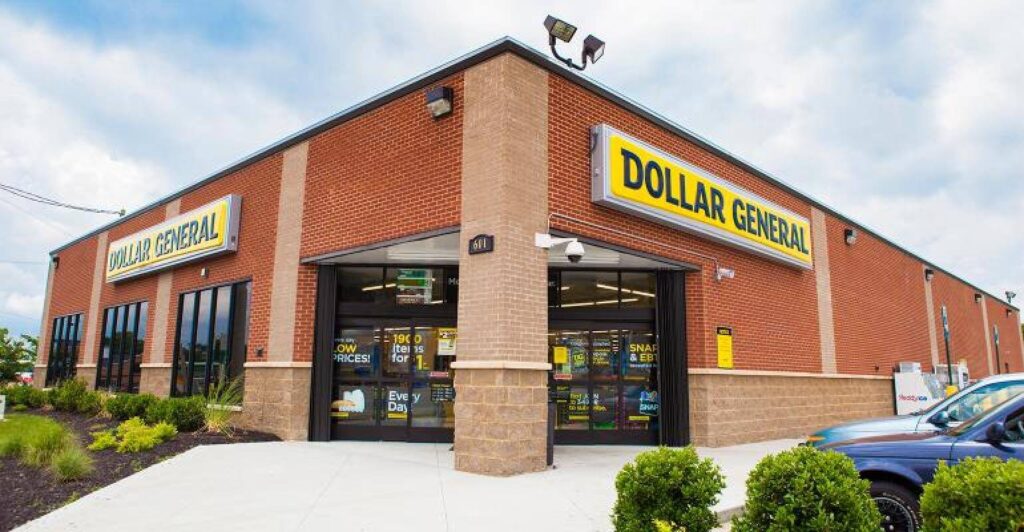

3. Net Lease Retail DST Anchored by a National Tenant

A DST acquires a retail property under a triple-net (NNN) lease with a national chain, such as a pharmacy or branded retailer. In an NNN lease, the tenant assumes responsibility for property taxes, insurance, and maintenance, reducing the operational burdens. This structure offers relatively stable and predictable income. Given the passive role, investors do not manage landlord tasks; they simply receive lease payments, adjusted by scheduled rent escalations over time.

4. Medical Office DST Adjacent to a Hospital Campus

This DST invests in medical office buildings leased to clinics, outpatient services, and physicians. Given healthcare’s durable demand, these properties often achieve stable occupancy and long-term leases. The sponsor ensures building compliance with healthcare standards, handles tenant build-outs, and maintains equipment systems. Investors benefit from consistent cash flow derived from medical tenants and less susceptibility to retail disruption.

5. Self-Storage DST Portfolio in Secondary Markets

A DST may consist of multiple self-storage facilities across different states. Self-storage tends to perform relatively steadily regardless of macroeconomic swings, because individuals and businesses often need storage consistently. The DST’s sponsor manages operations, rental marketing, security, and facility maintenance. Investors gain from occupancy growth, fee adjustments, and property appreciation.

Benefits and Practical Advantages of DST Real Estate

DST real estate offers several tangible advantages that appeal to passive investors, especially those seeking tax-efficient, hands-off exposure to commercial real estate.

1. Tax Deferral via 1031 Exchange Eligibility

Well-structured DST interests qualify as replacement property in a 1031 exchange. This allows investors who sell a property to reinvest proceeds into DST real estate and defer capital gains taxes, preserving capital and compounding potential returns.

2. Passive Ownership without Management Burden

Investors need not engage in leasing, tenant relations, maintenance, or capital improvements. The sponsor handles all operational responsibilities, freeing investors from landlord hassles.

3. Access to Institutional-Grade Assets

DST real estate enables individual investors to participate in large, high-quality commercial properties that would otherwise be out of reach due to cost, scale, or complexity.

4. Diversification Across Asset Classes and Geographies

Because DSTs often group multiple properties or allow investment in different sectors (industrial, multifamily, retail, healthcare), investors can diversify more easily, reducing concentration risk in one property or region.

5. Predictable Cash Flow with Lease Structures

Many DSTs employ long-term leases, creditworthy tenants, and rent escalation clauses offering relatively stable, predictable distributions even in fluctuating markets.

6. Estate Planning and Succession Benefits

DST interests can be divided, passed down, or inherited. Because the nature of the trust is fractional, interests may be more easily segmented across heirs than a whole property. Beneficial owners may benefit from step-up in cost basis rules at death.

7. Lower Minimum Investment Thresholds

While not universally true, many DST offerings allow fractional ownership with modest capital requirements (e.g., $100,000 or more), making institutional-level investments more accessible to individual investors.

8. Structural Discipline and Limited Sponsor Flexibility

The restrictions embedded in DST agreements (prohibiting debt renegotiation, limiting capital expenditures, mandating distribution) introduce discipline and reduce sponsor discretion, which can help preserve investor expectations.

These advantages make DST real estate compelling for investors seeking real estate exposure without operations, tax deferral, and diversified portfolio strategies.

Use Cases: Problems Solved by DST Real Estate

DST real estate is not just theoretical; it addresses real investor challenges and strategic needs.

1. Timing and Execution in 1031 Exchanges

Many real estate sellers struggle to identify, negotiate, and close replacement properties within IRS time limits (45-day identification, 180-day closing). DST offerings are often ready-to-go, allowing seamless transitions without risk.

2. Reducing Management Overload

Investors holding multiple rental properties may be stretched thin managing tenants, repairs, and operational complexities. Converting those holdings via sale and reinvestment into DST real estate allows them to maintain passive income without management burdens.

3. Diversifying Geographical and Asset Exposure

An investor heavily concentrated in one market is vulnerable to local downturns. Through DST real estate, they can reallocate into different regions or sectors more easily, thereby reducing concentration risk.

4. Creating Retirement or Income Portfolios

In later life, active management becomes less appealing. DST real estate offers passive, reliable cash distributions, making it conducive to retirement income strategies.

5. Enhancing Estate Liquidity and Transferability

Large property holdings can be cumbersome to divide in an inheritance. Fractional DST interests can be easier to distribute among heirs. The structure can also enable greater flexibility in legacy planning.

Risks, Limitations, and Considerations

Even with its advantages, DST real estate carries inherent risks and structural limitations that every investor must evaluate.

Illiquidity

DST interests are typically illiquid. Investors must often wait until the sponsor executes a full-cycle exit (e.g., property sale or refinancing) before realizing proceeds. Secondary market transfers are rare and often subject to restrictions.

Sponsor Dependence and Execution Risk

Investors relinquish control to the sponsor. The performance, underwriting assumptions, capital expenditure discipline, and exit decisions rest entirely with that sponsor. Poor management or misaligned incentives can erode returns.

Operational and Capital Expenditure Constraints

DST agreements often restrict major capital improvements, refinancing, or reinvestment of sale proceeds. This limits flexibility to adapt to changing property needs.

Fee Drag

Sponsors charge acquisition, asset management, disposition, and administrative fees. High fees can erode yield, especially in modest growth scenarios.

Forced Conversion Risk

Some DSTs include clauses requiring mandatory conversion into nontraded REITs or operating partnerships at exit. Such forced conversions may end future 1031 exchange eligibility and impose illiquid structures on investors.

Investors should scrutinize offering documents, perform scenario stress testing, and assess sponsor track records before committing capital.

FAQ

1. Can I use DST real estate in a 1031 exchange?

Yes, if the DST is structured properly and complies with IRS requirements (such as passive structure, restricted capital flexibility, and distribution mandates), beneficial interests in a DST can be accepted as replacement property in a 1031 exchange.

2. What happens at the end of a DST investment period?

At exit (often 7–10 years), the sponsor typically sells the property and distributes proceeds to investors. Some DSTs may allow optional or forced conversions into nontraded REITs or operating partnerships, potentially ending further 1031 eligibility.

3. How do I evaluate a DST real estate offering?

Key evaluation criteria include the sponsor’s track record, property type and location, lease structure and tenant quality, projected cash flows, fee structure, exit strategy, compliance with DST restrictions, and transparency of reporting.