DST Properties for Sale Complete Guide to 1031 Exchange Real Estate

In the realm of real estate investing, DST properties for sale represent a niche but powerful option, particularly for investors looking to defer capital gains through a 1031 exchange. A Delaware Statutory Trust (DST) allows multiple investors to hold fractional ownership in institutional-grade properties without managing them directly. In this article, we explore what DST properties are, how they work, their benefits, technology roles, real-world examples, use cases, challenges, and FAQs, giving you a thorough, in-depth understanding.

Understanding DST Properties and Their Role in 1031 Exchanges

DST stands for Delaware Statutory Trust, which is a legal entity used to hold title to investment real estate. A DST can own one or more properties such as multifamily apartments, net lease retail buildings, industrial facilities, or self-storage assets. By buying beneficial interests in a DST, investors can gain exposure to large commercial real estate projects without owning a full property.

One of the main appeals of DST properties for sale is that beneficial interests in a properly structured DST may qualify as “like-kind” replacement property under U.S. Section 1031 exchange rules. This means that when you sell an investment property and reinvest into DST interests as a replacement, you can defer capital gains taxes—so long as you obey the timing and identification requirements of a 1031 exchange.

DST properties typically come with hands-off passive ownership. The sponsor or trustee handles property operations, leasing, capital expenditures, and management. Investors receive periodic distributions (if cash flow allows) and benefit from property appreciation, without day-to-day landlord duties.

It’s critical, however, to perform due diligence. Not all DST offerings are equal: variations arise in sponsor quality, property type, lease structures, debt levels, and hold periods. A well-vetted DST property can align with long-term income and tax-deferral goals.

Key Attributes and Structures of DST Offerings

DST offerings share several structural characteristics that distinguish them from direct real estate ownership or other real estate syndications.

First, DSTs frequently use fixed capital structures, meaning the sponsor does not actively remodel debt after closing or renegotiate major debt except under limited conditions. This predictability helps investors model returns. Also, many DSTs are offered debt-free, meaning no mortgage encumbers the property, reducing default risk.

Second, DSTs often lease to credit-worthy, long-term tenants (net lease, single-tenant or multi-tenant), which create stable income streams. Because they target institutional-grade tenants, DSTs enhance income transparency and reduce vacancy risk.

Third, DST investments have minimum investment thresholds (commonly from $25,000 up to six figures) and are typically open only to accredited investors. They are illiquid; if there is rarely a public secondary market, investors often must hold through the sponsor’s chosen hold period (e.g., 7 to 10 years).

Fourth, the sponsor selection and due diligence process is paramount. A strong sponsor with a track record, conservative underwriting, transparent disclosures, and robust operational controls can differentiate a good DST from a risky one.

Fifth, investors should analyze cash flow distributions, growth assumptions, capital event projections (like property sale or refinancing), and exit strategies. Because DSTs don’t permit ongoing active decision-making by investors, the initial underwriting matters heavily.

Technology’s Role in Modern DST Property Management

Even though DST investors are passive, the operations behind DST properties increasingly rely on technology to maintain efficiency, transparency, and performance.

Modern DST assets often integrate property management software and platforms that track lease status, rent collections, tenant turnover, maintenance schedules, and financials. These systems help sponsors deliver more accurate and timely reporting to investors.

Data analytics and performance monitoring allow sponsors to benchmark operations across portfolios, identify underperforming assets, and make proactive adjustments in property maintenance, capital budgeting, and expense control.

For properties such as industrial, storage, or multi-tenant assets, IoT sensors, energy management systems, and smart building features help reduce costs (power, heating, cooling, lighting) and extend infrastructure life. These technology-driven efficiencies directly improve cash flow margins, benefiting DST investors.

Finally, online investor portals and digital reporting enhance transparency: investors can view property-level financials, distribution history, underwriting models, and sponsor commentary. This improves confidence, reduces information asymmetry, and allows investors to monitor performance more actively (even if decisions rest with the sponsor).

Example DST Properties for Sale and Their Relevance

Below are three real-world DST property examples (or categories commonly offered) illustrating how DST investments work in practice and how the benefits and risks manifest.

1. Multifamily Apartment Portfolio DST

A DST may package several residential apartment buildings under a single trust. Investors earn from rental cash flow, occupancy growth, and eventual property appreciation. For instance, a DST could consist of 200–500 units across multiple markets to diversify geographic and market risk. Because apartments tend to have higher turnover, the sponsor’s property management efficiency, maintenance planning, and market selection become critical. The DST’s underwriting will project rental growth, occupancy stability, and replacement reserves.

2. Net Lease Retail Building DST

These DSTs invest in single-tenant or multi-tenant retail properties under triple net (NNN) leases, where tenants bear property taxes, insurance, and maintenance. Example: a retail pharmacy chain building leased under a 15- to 20-year lease. Here, the predictability of rent and low landlord burden appeal to conservative investors. The sponsor’s choice of tenant credit, lease structure (renewal rights, rent escalations), and market location are vital to income integrity.

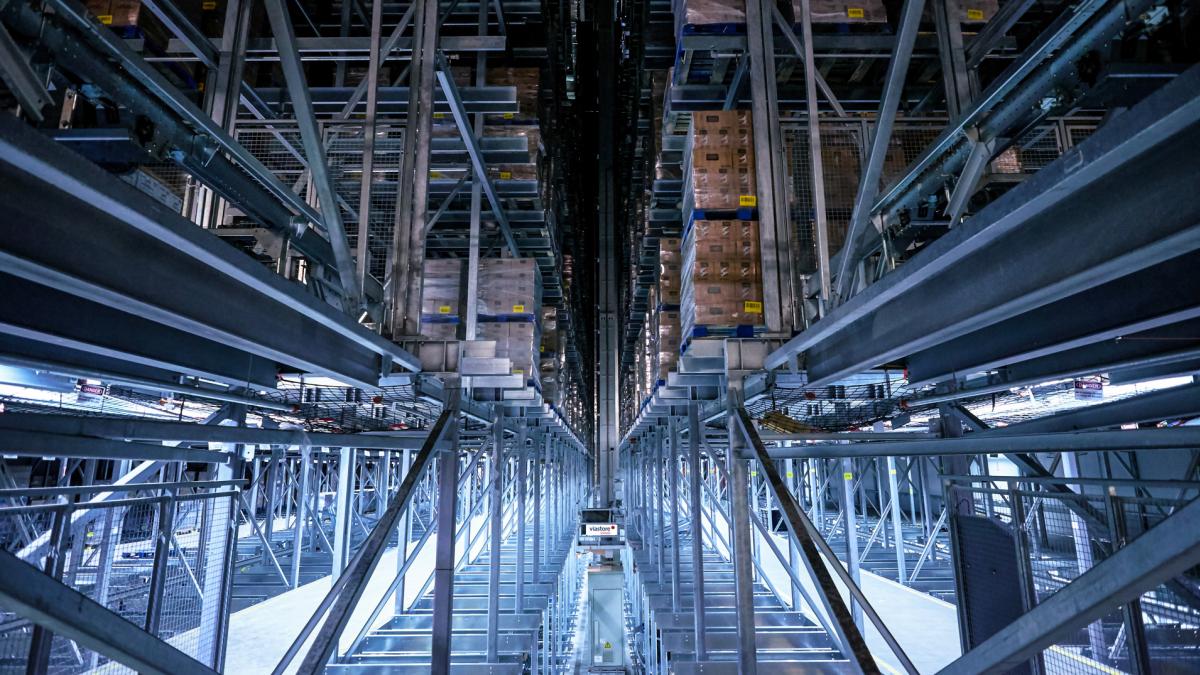

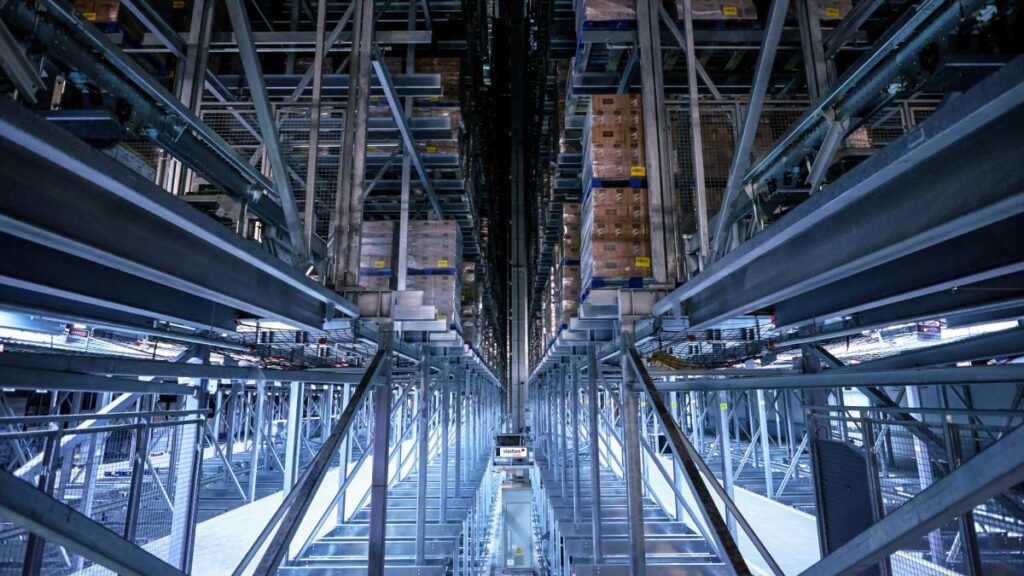

3. Industrial / Logistics Warehouse DST

With e-commerce growth, industrial properties, warehouses, distribution centers, and fulfillment hubs are popular DST asset classes. A DST might acquire a modern warehouse near transportation nodes. Income comes from long-term leases to logistics providers. The heavy demand for last-mile logistics gives this type of DST potential for rent escalation and value growth. Sponsors must manage capital expenditures (roof, HVAC, loading dock systems) and ensure the location remains relevant in a changing logistics landscape.

Each example shows how DST offerings differ by property type, lease structure, and risk-return profile. An investor must align DST selection with risk tolerance, desired return, and time horizon.

Benefits and Practical Advantages of DST Properties for Sale

DST investments offer several practical advantages, especially when aligned with 1031 exchange strategies.

1. Tax Deferral via 1031 Exchange Compatibility

DSTs that meet IRS guidelines qualify as eligible replacement properties under a 1031 exchange. This allows investors to defer capital gains tax when selling real estate and reinvesting into DST interests—thus preserving more capital for reinvestment.

2. Passive Ownership and Hands-Off Management

DST investors do not manage tenants, maintenance, or operations. The sponsor handles all active management, allowing investors to earn real estate income without day-to-day responsibilities.

3. Access to Institutional-Grade Real Estate

DSTs lower the barrier to entry. Instead of having millions to acquire a commercial building alone, investors can own a fraction of large, high-quality properties that might otherwise be inaccessible individually.

4. Diversification and Risk Mitigation

By investing in DSTs across property types or geographies, investors can spread risk. A bad outcome in one market may be offset by performance in another—something harder to manage with a single-property investment.

5. Predictability and Structural Discipline

Because DSTs often have fixed capital structures and limited sponsor flexibility, the underwriting assumptions tend to hold unless extreme market forces intervene. This gives more predictability compared to active syndications, where sponsor decisions can change leverage or strategy mid-cycle.

6. Potential for Steady Cash Flow

DSTs distribute net operating income (after fees and reserves) as cash flows, providing regular distributions to investors. Because DSTs prioritize stable tenants and long leases, this revenue stream can be relatively steady in stable markets.

These benefits make DST properties appealing, especially for investors who want real estate exposure with tax efficiency, minimal operational burden, and access to premium assets.

Use Cases: Problems Solved by DST Properties for Sale

DST investments solve several real-world challenges that many real estate investors face.

1. Managing Capital Gains Tax Liabilities

For investors disposing of high-value properties, DSTs provide a way to reinvest proceeds while deferring capital gains taxes—preserving more capital and compounding growth potential via 1031 rules.

2. Offloading Management Burden

Investors who own multiple physical rental properties may become overwhelmed by landlord duties, tenant issues, and maintenance costs. Transitioning to DST interests reduces those burdens, freeing time and reducing stress.

3. Facilitating Portfolio Transition or Diversification

An investor may wish to shift from residential to industrial, retail, or net lease assets. DSTs enable this transition without having to buy entire properties, just acquire interests in different property types.

4. Breaking Up Geographic Concentration

If an investor’s current holdings are concentrated in one metro or region, DST acquisitions in other regions help reduce exposure to localized market downturns (e.g., job loss, regulatory shifts, natural disaster).

5. Liquidity Planning for Retirement or Estate

Though DST assets are not highly liquid, the structure and projected payouts may fit a stable income stream during retirement. Moreover, DST interests can sometimes be planned into an estate strategy with known cash flow projections and exit plans.

These use cases demonstrate how DST properties serve not just as investments, but also as strategic portfolio tools.

Challenges, Risks, and Considerations

Like all investments, DST properties come with risks and limitations that investors must evaluate.

First, illiquidity: DSTs generally lack secondary markets. Until the sponsor markets or sells the property, you may not be able to exit early. This limits flexibility relative to publicly traded REITs or stocks.

Second, dependency on sponsor execution: Because investors cede control, sponsor competence, alignment of interests, and transparency are critical. A weak sponsor can impose poor decisions and cost overruns, harming returns.

Third, market risk and property-level risk: Real estate cycles, vacancy, lease renewal, property degradation, or changes in demand can affect performance. Sponsorship underwriting must account for worst-case scenarios.

Fourth, tax complexity and regulatory risk: DSTs must strictly adhere to IRS rules to maintain 1031 eligibility. Any misstep in structure, lease terms, or distributions can jeopardize tax benefits. Regulatory changes or IRS scrutiny could affect the entire DST space.

Fifth, limited investor flexibility: Because DST structures are fixed post-close, investors usually cannot influence financing decisions or capital improvements. There is limited room for renegotiation or proactive refinancing.

Sixth, fees and costs: Sponsors charge acquisition fees, asset management fees, and distribution fees. High fees can erode net returns, especially in modest growth environments.

To mitigate these, prudent investors should conduct rigorous sponsor due diligence, review the offering memorandum, stress-test projections, and limit exposure to a manageable portion of their portfolio.

Conclusion

DST properties for sale offer a compelling path for real estate investors seeking tax-efficient, passive, and diversified exposure to institutional-grade assets. By understanding how DST structures work, the role of technology in operations, and evaluating real-world examples, you can better position yourself to choose high-quality DST offerings that align with long-term goals.

While benefits like tax deferral, hands-off management, and access to large assets are attractive, risks such as illiquidity, sponsor reliance, and structural rigidity must be acknowledged and managed.

If you’re seeking to deploy capital from a 1031 exchange or transition from active property management to passive real estate income, DST properties are a powerful tool provided you approach them with rational analysis and caution any real estate investment demands.

FAQ

1. What types of properties are commonly offered via DSTs?

DST offerings often include multifamily apartment buildings, net-leased retail or commercial properties, industrial warehouses, self-storage facilities, and healthcare or medical office properties. These asset classes tend to have stable income profiles with institutional tenant demand.

2. How long is the typical DST investment hold period?

Most DSTs project a holding period of 7 to 10 years before a liquidity event (sale, refinancing, or recapitalization). Because investors have limited control, it’s wise to plan to hold through the sponsor’s exit strategy.

3. Can I sell my DST interest before the sponsor’s exit?

In most cases, no. DST interests are illiquid, and there is rarely a secondary market. Some sponsors may allow limited transfers under strict conditions, but investors should assume their capital is tied up until the DST’s planned exit.