American Healthcare REIT Deep Dive into Healthcare Real Estate Trust

The healthcare real estate market is one of the most resilient and rapidly expanding sectors within the broader property investment world. At the heart of this sector stands American Healthcare REIT (AHR), a diversified real estate investment trust specializing in properties like senior housing, skilled nursing facilities, and medical office buildings.

As healthcare needs evolve and populations age, REITs such as AHR play an increasingly vital role in providing the infrastructure that supports essential medical and long-term care services. This article explores the business model, portfolio composition, technological innovations, benefits, use cases, and risks associated with American Healthcare REIT, providing an in-depth understanding for investors seeking exposure to this critical market segment.

What Is American Healthcare REIT and Its Strategic Focus

American Healthcare REIT (AHR) is a self-managed, publicly registered real estate investment trust that acquires, owns, and operates healthcare-related properties across the United States and select international markets. Its primary focus areas include:

-

Senior housing communities meet the needs of aging populations.

-

Skilled nursing facilities provide specialized medical care and rehabilitation.

-

Medical office buildings, housing outpatient and specialty medical services.

AHR’s core strategy revolves around balancing stable rental income with long-term growth potential. The company diversifies across asset types and geographies to mitigate market volatility and tenant risk. This structure enables AHR to benefit from steady cash flow through lease agreements with healthcare operators while positioning itself for capital appreciation as property demand grows.

Unlike traditional REITs that focus on office or retail properties, healthcare REITs like AHR are closely tied to macroeconomic factors such as demographic trends, healthcare policies, and insurance reimbursement models. This connection to essential services gives healthcare REITs a defensive profile, often making them more stable during economic downturns.

Portfolio Composition and Operating Framework

AHR manages a vast portfolio of properties that span senior living facilities, skilled nursing homes, and outpatient medical centers. The REIT’s holdings cover millions of square feet in healthcare real estate, representing a multi-billion-dollar investment footprint.

Each asset class serves a distinct function:

-

Senior housing targets the rapidly growing demographic of retirees and elderly individuals.

-

Skilled nursing focuses on post-acute care and rehabilitation services for patients requiring long-term treatment.

-

Medical office buildings (MOBs) accommodate outpatient care facilities, diagnostics, and specialty clinics.

The financial health of a REIT like AHR can be evaluated using core metrics such as:

-

Funds From Operations (FFO) measures the cash flow generated from real estate operations.

-

Adjusted Funds From Operations (AFFO) adjusting for maintenance and recurring capital expenditures.

-

Occupancy and lease term stability indicate the strength of tenant relationships and income predictability.

-

Net Asset Value (NAV) assesses property market value minus liabilities.

AHR employs a self-managed structure, meaning internal teams handle property operations, acquisitions, and asset management. This approach aims to enhance accountability, streamline decision-making, and maintain tighter control over expenses.

Technology Integration in Healthcare Real Estate

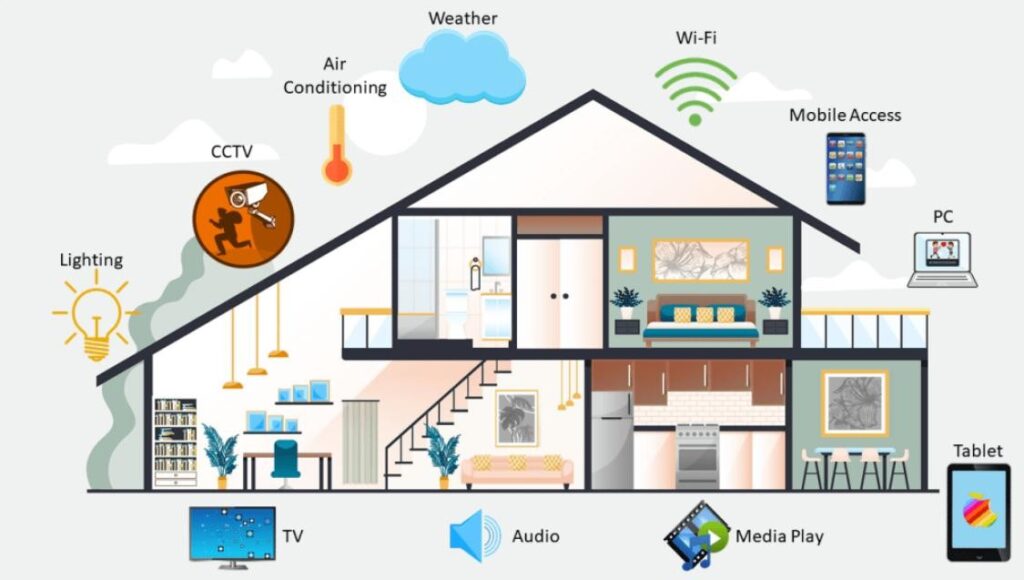

Technology has become indispensable in the modern management of healthcare real estate. For AHR, the integration of digital systems enhances both operational efficiency and asset value.

Smart facility management tools are widely used across the portfolio. IoT sensors monitor temperature, air quality, and energy consumption to maintain optimal conditions for patient safety and cost control. Predictive maintenance software alerts operators to system inefficiencies or potential failures before they escalate.

In addition, data analytics platforms provide insights into tenant performance, rental trends, and healthcare market demand. By analyzing demographic shifts, AHR can identify high-growth regions for future acquisitions and anticipate where medical infrastructure will be most needed.

Investor transparency is another area enhanced by technology. Digital dashboards and portals allow stakeholders to track property performance, occupancy, and cash distributions in real time, ensuring accountability and confidence among investors.

Technology also supports compliance management, helping ensure that healthcare facilities meet state and federal regulations. Automated systems keep records of safety inspections, building codes, and certification renewals to avoid regulatory risks.

Real-World Examples of Healthcare REIT Operations

To understand AHR’s business model more clearly, let’s look at examples of the types of properties and operations typically included in its portfolio.

1. Medical Office Building in a Growing Suburban Market

One segment of AHR’s portfolio consists of outpatient medical facilities located in high-growth suburban areas. These properties typically host primary care offices, imaging centers, and specialty clinics. Long-term leases with reputable medical groups ensure stable cash flow and reduced vacancy risk.

2. Senior Housing Communities for Assisted Living

AHR’s senior housing assets cater to the increasing number of retirees seeking independent or assisted living arrangements. These communities combine residential living with access to healthcare and wellness services. They provide consistent occupancy rates and predictable revenue streams supported by demographic demand.

3. Skilled Nursing and Rehabilitation Centers

AHR owns multiple facilities offering skilled nursing, rehabilitation, and post-surgical recovery services. These assets are leased to healthcare operators under long-term agreements. Given the high infrastructure requirements of such properties,l ike advanced medical systems and safety features, they represent long-duration, capital-intensive investments with strong tenant retention.

AHR diversifies across states and property types to balance risk. For example, a combination of outpatient medical buildings and assisted living facilities allows the company to offset performance fluctuations in one segment with stability in another.

These examples demonstrate how AHR’s diversified structure supports steady returns while mitigating exposure to market or operational downturns.

Benefits of Investing in American Healthcare REIT

Investing in a healthcare REIT like AHR provides several tangible advantages for both institutional and individual investors:

1. Stable and Recession-Resistant Income

Healthcare services remain essential regardless of economic cycles. Facilities such as medical offices, senior housing, and skilled nursing centers continue to generate rent even during market downturns.

2. Long-Term Lease Structures

AHR typically signs long-term leases, often 10 to 20yearsa s, with healthcare operators. These contracts ensure consistent cash flow and minimize turnover risk.

3. Inflation-Linked Revenue Growth

Many leases include escalation clauses tied to inflation, helping maintain purchasing power and income growth over time.

4. Diversification Benefits

Healthcare REITs provide exposure to a sector largely uncorrelated with retail, office, or industrial real estate. This diversification enhances portfolio stability.

5. Access to Specialized Assets

Healthcare properties are difficult to develop and manage due to strict regulatory standards and technical requirements. AHR’s experience gives it a competitive edge in acquiring and managing such assets.

6. Social Impact and ESG Alignment

Investing in healthcare real estate supports community health infrastructure. Many investors consider this alignment with environmental, social, and governance (ESG) goals a secondary benefit.

Use Cases: How American Healthcare REIT Solves Investor Challenges

Healthcare REITs like AHR offer practical solutions to several investment and portfolio management challenges:

1. Generating Predictable Passive Income

Investors seeking reliable monthly or quarterly distributions benefit from healthcare REITs’ steady rent income from long-term healthcare operators.

2. Diversifying Beyond Traditional Real Estate

By holding assets in the healthcare sector, investors reduce exposure to more cyclical sectors like retail or hospitality.

3. Inflation and Interest Rate Hedge

Because healthcare demand is steady, REIT income often rises with inflation, acting as a hedge against rising costs and interest rates.

4. Reduced Operational Burden

Unlike direct property ownership, REIT investors gain exposure to diversified healthcare assets without managing tenants or maintaining facilities themselves.

5. Supporting Growing Healthcare Demand

Investing in healthcare real estate indirectly contributes to expanding the capacity of the medical system, meeting social and demographic needs while earning stable returns.

Risks and Challenges in Healthcare REIT Investment

While the benefits are substantial, healthcare REIT investments also involve specific risks that must be understood:

-

Tenant Risk: Financial stress or mismanagement by healthcare operators can affect rent payments.

-

Regulatory and Policy Risk: Changes in Medicare, Medicaid, or healthcare laws can influence operator profitability.

-

Operational Complexity: Facilities require higher capital expenditure and compliance costs than standard commercial buildings.

-

Interest Rate Sensitivity: Rising rates can increase debt costs and affect REIT valuations.

-

Market and Geographic Concentration: Too much exposure to one market or operator increases vulnerability.

-

Liquidity Constraints: Real estate investments, including REIT shares, can experience volatility and limited liquidity during downturns.

Effective risk management, such as diversifying tenant mix, maintaining conservative leverage, and focusing on long-term leases, is essential to preserving capital and sustaining returns.

Conclusion

American Healthcare REIT represents a strategic avenue for investors seeking exposure to one of the most resilient and socially impactful sectors of real estate. Its focus on senior housing, skilled nursing, and medical office properties provides both stability and growth potential.

Through disciplined acquisitions, portfolio diversification, and integration of modern technology, AHR continues to demonstrate how healthcare infrastructure can serve as a reliable investment vehicle amid economic uncertainty.

For investors looking to align profit with purpose, healthcare REITs like AHR offer a balanced blend of dependable income, inflation protection, and tangible societal benefit.

FAQ

1. What makes American Healthcare REIT different from other REITs?

AHR specializes in healthcare-related real estate properties that serve essential medical and long-term care needs, making it less cyclical and more defensive than retail or office REITs.

2. How does AHR generate its income?

The REIT earns revenue through long-term lease agreements with healthcare operators who use its facilities for senior housing, medical offices, and nursing care.

3. What risks should investors consider before investing in AHR?

Investors should be aware of regulatory risks, tenant stability, and interest rate fluctuations, all of which can influence income consistency and asset valuation.