Property Financial Planner Comprehensive Strategy Guide

Real estate investing is powerful, but it carries complex financing structures, tax implications, market dynamics, maintenance risks, and exit timing, all interplay. A property financial planner is a specialist who helps investors navigate this complexity by integrating property decisions into a holistic financial plan. They not only assist in property transaction decisions but also ensure every property move aligns with broader financial goals and risk constraints.

In this guide, you will learn what a property financial planner does, their core expertise, how technology supports their work, real-world tools or models, the benefits of engaging one, concrete use cases, pitfalls, selection tips, and frequently asked questions.

What Exactly Does a Property Financial Planner Do?

A property financial planner offers financial advice and strategic planning specifically tuned for real estate investors. Unlike general financial planners who treat property as one asset class among many, or real estate brokers who focus on transactions, this role merges both domains. They evaluate property opportunities with financial discipline and ensure property decisions support long-term wealth objectives.

Their responsibilities typically include:

-

Evaluating property investments through financial modeling and scenario analysis

-

Designing optimal financing and capital structure

-

Advising on tax, depreciation, and ownership entity structuring

-

Managing portfolio risk and diversification

-

Monitoring ongoing performance and adjusting strategy

-

Planning exit, refinancing, or legacy transfer pathways

Thus, a property financial planner becomes a long-term partner, not just a deal adviser.

Core Expertise & Knowledge Areas

Deep Financial Modeling & Sensitivity Analysis

A key competency is building advanced financial models that project rental income, operating costs, maintenance, capital expenditures, financing expenses, taxes, and net cash flows across years. From these projections, planners derive metrics like internal rate of return (IRR), net present value (NPV), cash-on-cash returns, and equity multiples.

They then conduct sensitivity analysis, adjusting key variables such as vacancy, interest rate increases, and cost escalations to see how robust the investment is under stress scenarios. This gives investors clarity on downside risk and the margin of safety in any property deal.

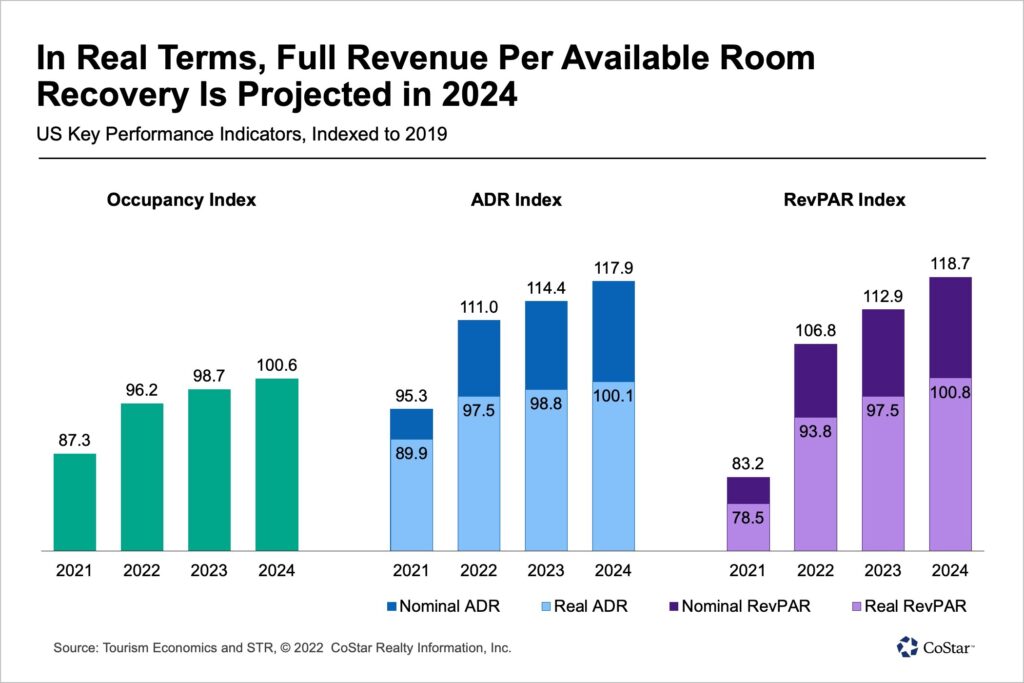

Market & Location Intelligence

Even the strongest model fails if location assumptions are incorrect. Property financial planners analyze rental trends, supply pipelines, demographic shifts, infrastructure development, zoning changes, and neighborhood dynamics. They use comparative market analysis to validate valuations and overlay mapping or GIS insights to identify growth corridors or undervalued pockets.

This ensures that financial assumptions are anchored in market reality, reducing speculation risk.

Capital & Financing Strategy

How a property is financed how much leverage, interest terms, maturity, amortization schedule, and refinancing windows, can dramatically affect returns and risk. Planners assess fixed vs variable interest, interest-only periods, mezzanine debt or layered structures, refinancing triggers, and prepayment rights.

They design financing parameters that amplify upside while preserving flexibility and avoiding liquidity stress.

Tax, Depreciation & Ownership Structure

Taxes can erode property returns if managed poorly. Financial planners advise on structuring property holdings (LLCs, trusts, partnerships), deploying depreciation or cost segregation techniques, and planning exits to minimize capital gains or rollover costs. They stay abreast of local tax regulations and regulatory changes to adapt strategy accordingly.

Risk Management & Portfolio Design

Every property carries risk: market cycles, regulation, maintenance surprises, interest rate shifts, and local disruptions. Planners stress-test portfolios across scenarios and advise diversification across property types or geographies. They often recommend reserve reserves or contingency buffers to absorb shocks.

Exit Planning, Liquidity & Legacy Design

Properties aren’t held forever. A core role is determining when and how to exit or refinance, structuring phased sales, timing disposals with market cycles, and ensuring liquidity when needed. For long-term investors or families, planners integrate legacy transfer or succession plans so property wealth is passed efficiently.

Client Communication, Governance & Reporting

Complex models and strategies mean little unless the client understands and trusts them. Planners translate technical detail into clear plans, deliver periodic performance reviews (actual vs forecast), flag deviations, and maintain governance structures aligning incentives and transparency.

The Role of Technology in Property Financial Planning

Modeling & Scenario Tools

Rather than build every model manually, planners use dedicated software that automates cash flows, supports toggles for “what-if” adjustments, and visualizes outcomes. This speeds strategy iteration and reduces human error.

Market Data & Analytics Platforms

Property planners tap into platforms aggregating transaction records, rental growth indices, demographic trends, supply forecasts, and zoning changes. This data underpins realistic assumptions and surfaces market inflections before general awareness.

Portfolio Dashboards & Monitoring

Once properties are operating, dashboards ingest actual performance data rents collected, occupancy, and expenses, and compare to planned forecasts. Deviations trigger alerts. Planners then diagnose issues early and recommend corrective actions.

Workflow Automation & System Integration

Automating routine tasks ,data refreshes, report generation, alert integration among property management and accounting frees planners to focus on strategic insight instead of administrative burden.

Risk Simulation Engines

Advanced planners use engines that simulate thousands of future paths under adverse conditions (e.g., rent collapse, cost inflation, rate shock). This probabilistic insight forms the backbone of resilient planning rather than brittle assumptions.

Combined, these technologies allow planners to scale, maintain discipline, and be responsive in volatile markets.

Real-World Tools / Frameworks & Use Case Examples

Property Cash Flow Modeling Platform

This tool enables input of variables: acquisition cost, financing, rent escalation, costs, capex, and exit timing. It outputs multi-year cash flows, IRR, NPV, and sensitivity analyses.

Relevance: A planner uses this to compare different property options under identical assumptions. By adjusting vacancy, cost escalation, or financing, the planner illustrates tradeoffs and robustness. Clients gain clarity on which deal offers a sustainable return.

Market Analytics & Mapping Dashboard

This platform aggregates real estate transaction data, rental trend lines, demographic growth, supply pipeline, and mapping overlays. Users filter by region, property type, or timeline horizon.

Relevance: Before advising acquisition, the planner studies this dashboard to ensure projected rent growth, occupancy trends, and supply conditions support their model. It helps avoid speculative or overextended locations.

Portfolio Performance Monitoring Dashboard

This tool combines actual operational data rent collected, occupancy, maintenance, and cost, and compares it with model forecasts. Divergences are highlighted, enabling timely review.

Relevance: The planner monitors assets continuously. If a property veers off plan (cost rise, revenue lag), the dashboard alerts the planner. The planner investigates root causes and recommends remedial measures, repositioning, refinancing, and operational improvements to protect returns.

Benefits of Engaging a Property Financial Planner

More Strategic, Data-Driven Decisions

Instead of scattershot property buys, you benefit from disciplined, analytic decisions. The planner ensures each property furthers your financial objectives and risk parameters.

Enhanced Risk Mitigation & Resilience

Through scenario testing, stress paths, and buffers, the planner helps shield your portfolio from volatility. Your strategy is built to endure downturns.

Capital Efficiency & Return Leverage

With optimal financing, restructuring, and timing, the planner helps extract stronger returns per capital deployed without reckless leverage.

Tax Efficiency & Structural Strength

Better structuring, depreciation, and exit timing lead to more after-tax returns retained. The planner ensures your net gains are maximized legally.

Real-Time Oversight & Adaptive Strategy

You are not left in the dark. The planner’s dashboards and monitoring detect underperformance early, enabling course corrections before losses deepen.

Scalability & Delegated Complexity

As your holdings grow, the planner plus system infrastructure takes on complexity. You can scale intelligently without chaos.

Transparency & Accountability

Clear reporting, performance vs plan, and open communication ensure you see how your investments evolve and why adjustments are made.

Use Cases: Real-Life Scenarios

Use Case 1: Comparing Properties Across Markets

An investor is evaluating two offerings in different cities. The planner builds models with localized rent projections, tax regimes, cost escalations, financing, and exit timing. The urban property shows a higher nominal yield, but the suburban property is more resilient under adverse scenarios. The investor picks with confidence.

Use Case 2: Refinancing Ahead of Rate Increases

Debt is maturing as interest rates are expected to climb. Without planning, refinancing could crush cash flows. The planner simulates refinancing, term extension, layered debt, or partial repayment options. The chosen structure safeguards liquidity while preserving upside.

Use Case 3: Mid-Hold Underperformance Recovery

A property begins underperforming when expense growth outpaces rent, and vacancy rises. The performance dashboard flags a growing variance. The planner investigates operational inefficiencies, tenant issues, or market shifts, and recommends intervention (curated repairs, rent adjustments, repositioning, or refinancing). The yield recovers gradually.

Use Case 4: Phased Exit & Legacy Transfer

An investor approaching retirement wants to extract liquidity gradually while keeping a core portfolio. The planner sequences disposals aligned with tax windows and market peaks, structures ownership transitions (trusts or entities), and preserves ongoing income. The investor secures liquidity without destabilizing the portfolio or incurring heavy tax penalties.

Challenges & Things to Watch

Overreliance on Assumptions

All models rest on predictions of rent growth, vacancy, and cost inflation. If real conditions diverge sharply, outcomes differ. Strong planners revisit assumptions regularly and recalibrate.

Complexity Overload

Too many variables and branches can confuse clients. Expert planners simplify insight into actionable guidance, not overwhelm with numbers.

Regulatory or Tax Changes

Law shifts, zoning policy changes, or tax reform can disrupt even well-conceived plans. Planners must monitor environments and adapt.

Conflicts of Interest

If a planner also earns commissions tied to property deals, guidance may be biased. Transparency, disclosure, and aligned compensation are essential.

Cost vs Benefit for Smaller Portfolios

For modest property holdings, the cost for deep planning must justify the value. A planner should calibrate the scope to ensure the incremental benefit exceeds the fee.

How to Choose a Quality Property Financial Planner

-

Verify track record in real estate investing and strategic planning

-

Assess depth in modeling, tax structuring, and market insight

-

Evaluate clarity in communication. Can they explain complex things simply?

-

Check fee alignment (avoid commission bias)

-

Confirm independence and conflict disclosure

-

Ensure usage of analytics tools, dashboards, and data systems

-

Ask for client references, case studies, and sample plans

When interviewing, ask them to walk you through a sample property model, how they adapt when actuals deviate, and how they maintain ongoing alignment and oversight.

FAQ

Q1: Is a property financial planner only for large investors?

A1: No. Even smaller property investors benefit. The planner can tailor services to focus on financing, tax optimizations, risk buffers, and exit planning without requiring full portfolio complexity.

Q2: How do property financial planners charge for their services?

A2: Various models: fixed project fees, hourly consulting, retainers, or performance-based fees (shared in incremental returns). The best structure aligns the planner’s incentives with your outcomes.

Q3: Can a general financial planner or real estate agent serve as a property financial planner?

A3: They can partially, but often lack full depth. Real estate agents focus on deals, and general planners may lack in-depth modeling or market specificity. A property financial planner combines both domains to deliver strategic, data-driven, property-focused guidance.