Property Financial Advisor Strategic Investment Guide

Property investment carries high potential, but with it comes complexity; every decision from purchase to exit has financial ramifications. A property financial advisor provides the insight, analysis, and strategy needed to turn property holdings into sustainable wealth. In this article, you will explore what a property financial advisor does, their core competencies, how technology supports their work, real-world examples and use cases, the benefits of engaging one, challenges to watch, tips for choosing the advisor, and FAQs to solidify your understanding.

What Is a Property Financial Advisor?

A property financial advisor is a professional who guides investors in making sound financial decisions regarding property investments. This role goes beyond mere property transactions and encompasses structuring, funding, risk control, tax optimization, performance monitoring, and exit planning.

They act as a bridge between real estate expertise and financial strategy, ensuring every property decision fits within a coherent wealth plan. They help clients with due diligence, cash flow forecasting, debt versus equity choices, ownership structure, tax implications, and adapting strategy as markets evolve. Unlike typical real estate agents, their lens is financial and long-term.

Core Skills & Knowledge Areas

Investment Modeling & Cash Flow Forecasting

A key function is building robust models projecting revenues, expenses, capital expenditures, financing costs, and net cash flow over time. These models produce metrics like IRR, net present value, payback period, and equity multiples. The advisor also runs sensitivity analysis, adjusting variables like vacancy, rent growth, and interest rate changes to see how the numbers respond under stress.

This depth of modeling allows investors to compare multiple property proposals under consistent assumptions. It also clarifies the tradeoffs between risk and return for each investment choice.

Market Research & Location Intelligence

Behind every good property investment is deep local insight. Advisors examine rental trends, vacancy statistics, supply/demand forecasts, zoning changes, infrastructure developments, demographic shifts, and regional economic drivers. They may use geographic mapping tools to identify growth corridors, neighborhood trends, or emerging micro-markets.

By combining market insight with financial modeling, advisors ensure assumptions are realistic and location risk is managed. They avoid over-optimism in weak zones and spot opportunities in undervalued districts.

Capital Structure & Financing Strategy

How you finance a property, how much debt, what interest terms, amortization schedule, and debt maturity are central to returns. Property financial advisors design capital structures that balance leverage and stability. They assess options like fixed vs variable interest, interest-only periods, mezzanine debt, equity layering, and refinancing windows.

They also model refinancing sensitivity: what happens if rates rise, or loan renewal terms worsen. This planning helps avoid cash flow stress and maximize capital efficiency.

Legal Structuring, Tax & Depreciation Strategies

A strong advisor knows tax law and legal frameworks in their jurisdiction. They recommend ownership structures (corporate, trust, partnership) that manage liability and tax liability. They plan depreciation or cost-seg strategies to accelerate deductions. Exit planning also integrates capital gains, rollover mechanisms, or deferred sales strategies to reduce tax drag.

All these strategies preserve more of the investment’s value rather than letting tax erosion eat returns.

Risk Assessment & Portfolio Diversification

Every property faces unique risks: market downturns, regulations, maintenance surprises, interest hikes, and local disruptions. Advisors conduct scenario stress tests and downside scenarios to evaluate vulnerabilities. They often recommend portfolio diversification across property types, geographies, or economic segments to reduce correlated risk exposure.

They build protective buffers (reserves, contingencies) and monitor early warning signs to manage downside proactively.

Exit Planning & Liquidity Strategy

A property advisor helps design when and how to exit: hold vs sell vs refinance, staging sales, or recapitalization. They align exit timing with market cycles, tax windows, and investor cash needs. For investors with legacy goals, they also integrate succession and wealth transfer planning so property assets pass on smoothly.

Reporting, Communication & Governance

Technical brilliance is meaningless if clients don’t understand the path forward. A good advisor provides clear reporting, variance analysis (actual vs forecast), periodic reviews, and governance mechanisms to maintain alignment. They translate complex financial concepts into actionable guidance that he investor can trust.

Technology Tools That Empower Property Financial Advice

Modeling & Simulation Platforms

Advisors employ specialized software to build dynamic financial models with scenario toggles. These platforms enable real-time adjustments and sensitivity testing, saving time compared to manual modeling and improving accuracy.

Market Analytics & Property Intelligence Systems

Data platforms that aggregate transaction records, rent indices, demographic projections, pipeline development, and zoning alerts feed advisors with up-to-date insight. These tools help validate or challenge assumptions in models and identify emerging opportunities or red zones.

Portfolio Dashboards & Monitoring Tools

Once properties are live, dashboards ingest actual performance data—rent collections, occupancy, expense trends, and compare them with forecasts. Deviations are flagged automatically, prompting review or adjustment. This continuous feedback loop preserves return.

Automation & Workflow Integration

Repetitive tasks like updating models, generating reports, a nd syncing data among property management, accounting, and advisory systems are automated. Integration between systems ensures consistency and frees the advisor to focus on strategic thinking instead of administrative burden.

Risk Simulation Engines

Advanced tools let advisors run stress tests or Monte Carlo simulations across multiple variables. For example, what if interest rates rise 200 basis points, or rent falls 10%? These simulations reveal vulnerabilities, helping the advisor design strategies that are resilient under adversity.

Together, these technologies allow property financial advisors to scale efficiently, reduce errors, deliver insight quickly, and maintain a high level of vigilance over evolving conditions.

Real-World Tools & Use Cases

Property Financial Modeling Software

This is a specialized modeling environment where the advisor inputs parameters like acquisition cost, financing terms, rent assumptions, maintenance, capital expenditures, and exit timing. The software outputs metrics like IRR, cash-on-cash return, and scenario sensitivity.

Relevance: Advisors use this tool to compare multiple property opportunities under consistent assumptions. They adjust rent, cost escalation, or vacancy variables to test robustness. Clients gain clarity on which deal withstands stress.

Real Estate Market Insights Dashboard

An analytics tool aggregating property transaction data, rental growth charts, supply pipelines, demographic change maps, and economic indicators. It supports filtering by region, time period, property class, and more.

Relevance: Before recommending locations, the advisor examines this dashboard to validate that rent growth, occupancy trends, and supply conditions support their assumptions. They avoid entering saturated or weakening neighborhoods.

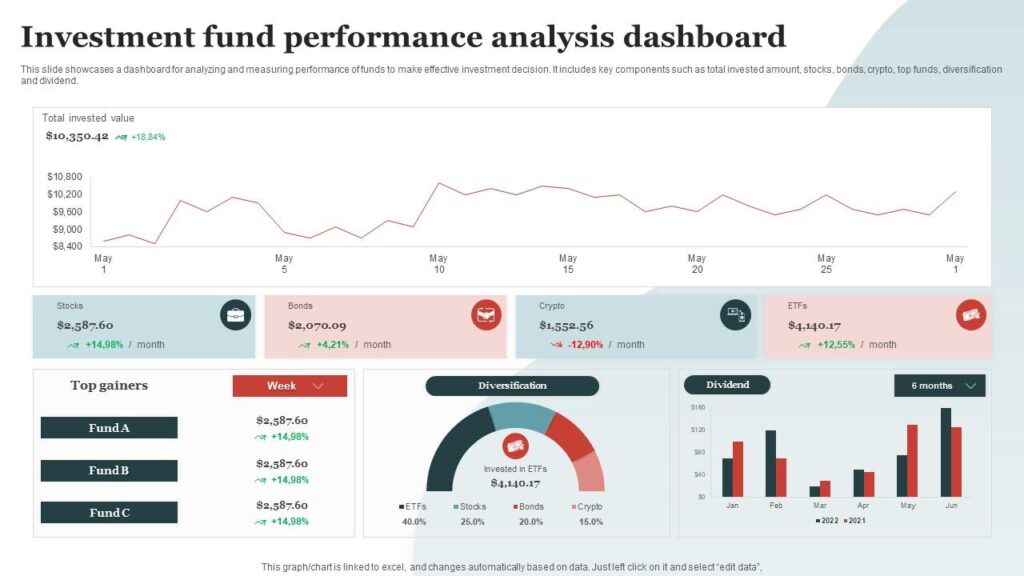

Portfolio Performance Analytics Dashboard

A platform that collects actual operational data (rent, expense, maintenance, vacancy) and compares it with the forecasted model outputs. It highlights deviations and trend divergences over time.

Relevance: Advisors use this to monitor portfolio health in real time. If a property strays from model expectations (rising costs, downward rent), they investigate root causes and recommend adjustments—renovation, lease reset, refinancing, or divestment.

Benefits of Engaging a Property Financial Advisor

Strategic Decision-Making Aligned with Goals

With an advisor, investing moves from guesswork to a data-driven strategy. Advisors ensure property decisionswhere, how much to borrow, and when to sell are consistent with your financial objectives, risk tolerance, and time horizon.

Risk Mitigation & Resilience

By modeling downside scenarios, creating contingency buffers, and diversifying, advisors reduce exposure to severe losses during market turbulence. They help you survive downturns, not just survive good times.

Capital Efficiency & Enhanced Return

An advisor’s structuring of debt, timing of refinancing, and allocation of equity maximize returns per unit capital. They identify leverage sweet spots and avoid overextending your balance sheet.

Tax Efficiency & Wealth Preservation

Through smart entity structuring, depreciation, exit planning, and tax optimization, advisors help you retain more returns rather than losing them to inefficient tax policies. This planning is often a major determinant of actual net profit.

Real-Time Oversight & Proactive Adjustments

With dashboards and monitoring systems, you don’t wait until things go wrong,g, you catch underperformance early. Advisors propose fixes when needed to keep your investment trajectory on track.

Scalability & Delegation of Complexity

As your property holdings grow, you won’t need linear growth in personal effort. The advisor plus systems manage complexity so you can scale thoughtfully, not stressfully.

Transparency & Accountability

Regular reporting, variance analysis, and clear explanation of strategic changes build trust. You see how each property performs relative to plan, how decisions evolved, and why you’re taking new steps.

Use Cases: Problems Solved & Applications

Use Case 1: Choosing Between Two Markets

An investor is torn between investing in City A or City B. The advisor models both with local rent trends, financing assumptions, taxes, and exit timing. Although City B promises higher upside, City A shows stronger stability under stress. The client makes an informed choice based on the risk-return tradeoff.

Use Case 2: Refinancing during Interest Volatility

An investor has maturing debt in an environment of fluctuating interest rates. The advisor simulates refinancing strategies partial repayment, extension, switching to variable/ fixed rates, or layering debt. The resulting plan protects cash flow and maintains flexibility.

Use Case 3: Correcting Underperforming Asset

One property falls short of projected returns due to rising maintenance and stagnant rents. The portfolio dashboard flags growing variance. The advisor investigates, identifies cost inefficiency or tenant mix issues, and recommends remedial actions (upgrades, rent reset, repositioning, refinancing). Over time, the yield rebounds.

Use Case 4: Staged Exit and Legacy Planning

A long-term investor wants liquidity gradually while preserving generational wealth. The advisor structures a phased exit plan aligned with market cycles, tax windows, and desired cash flow. Ownership restructuring ensures the remaining portfolio remains stable and transfers smoothly to heirs without heavy tax drag.

Challenges & Things to Watch For

Reliance on Assumptions

Every forecast is only as good as the assumptions: rent growth, vacancy, expenses, and rate changes. If assumptions shift, outcomes shift. A good advisor revisits assumptions frequently and remains agile.

Complexity & Communication

Too many variables or opaque modeling can confuse clients. The advisor must present insights in clear, actionable ways, not bury clients in data.

Regulatory & Tax Shifts

Legal changes, zoning regulations, or tax law revisions could disrupt existing strategies. Advisors must monitor regulatory environments and adjust proactively.

Conflicts of Interest

If an advisor also acts as a broker or receives commissions on deals, conflicts may arise. Transparency, disclosures, and alignment of incentives are critical.

Cost-Benefit for Smaller Investments

Deep advisory comes at a cost. For modest property portfolios, the investment in advice should be balanced with expected gains. Advisors should tailor the scope to avoid overcharging for marginal value.

How to Choose a Property Financial Advisor

-

Verify track record in real estate investing and outcomes

-

Assess the depth of financial modeling and analytical skills

-

Evaluate the clarity of communication and transparency

-

Ensure the fee structure aligns with performance and avoids hidden commissions

-

Check independence and conflict disclosures

-

Confirm use of modern tools, dashboards, and data systems

-

Ask for client references and previous real-world case studies

Invite advisors to present a sample model or scenario, explain how they adjust when reality diverges, and show how they’ll keep you informed over time.

FAQ

Q1: Do I need a property financial advisor for a single property?

A1: Yes, even a single investment can benefit. Advice can help optimize financing, tax structure, exit timing, and risk control. Advisors scale their service to your complexity.

Q2: How do property financial advisors charge?

A2: They may charge fixed project fees, hourly consulting rates, retainers, or a performance-based share. The ideal structure aligns advisor incentives with your return.

Q3: Can a property financial advisor replace a real estate agent or general financial planner?

A3: Not definitively. Agents are experts in deal execution; general planners cover broad financial goals. A property financial advisor focuses on blending property-level financial strategy with overall wealth goals. The three roles often complement each other.