Real Estate Investment Advisor Expert Strategies & Insights

Investing in real estate is one of the most powerful wealth-building strategies in the world. But property investment is also complex, full of moving parts such as market cycles, financing, taxation, and risk management. That’s where a real estate investment advisor steps in.

These professionals bring expertise that merges finance, data, and property insight to guide investors through the entire investment lifecycle from acquisition to exit. In this guide, you’ll learn exactly what a real estate investment advisor does, the tools they use, the technology behind their decisions, real-world use cases, and how they help investors protect and grow their property wealth strategically.

What Is a Real Estate Investment Advisor?

A real estate investment advisor is a specialist who helps individuals or organizations plan, execute, and manage real estate investments strategically. Unlike agents or brokers focused on transactions, advisors provide holistic, data-driven financial guidance designed to maximize long-term returns and minimize risk.

They combine real estate expertise with advanced financial knowledge to align property assets with broader investment objectives. Their services may include:

-

Market research and asset selection

-

Financial modeling and return forecasting

-

Financing strategy and capital structure design

-

Tax and ownership structuring

-

Diversification and risk management

-

Exit, liquidity, and succession planning

Their mission is simple but powerful: help investors treat real estate not as a one-time purchase but as a performance-optimized component of an overall wealth strategy.

Core Skills and Knowledge Areas of a Real Estate Investment Advisor

Financial Modeling and Cash Flow Projection

An advisor’s foundation is quantitative skills. They develop detailed financial models projecting rental income, operating costs, maintenance, taxes, and financing expenses. These models reveal metrics such as cash-on-cash return, IRR, NPV, and breakeven points.

Through sensitivity analysis, they stress-test outcomes under different conditions (e.g., if rent drops or interest rates rise). This allows investors to compare properties objectively and choose the best risk-adjusted return scenario.

Market Research and Location Insight

Every real estate market behaves differently. Advisors analyze local data on rental growth, demand and supply trends, vacancy rates, demographics, infrastructure expansion, and future zoning plans.

By integrating this information into investment forecasts, they identify emerging neighborhoods, undervalued districts, or overbuilt regions. A well-timed market entry or exit can significantly affect long-term returns, and advisors provide that precision.

Tax Strategy and Entity Structuring

Property taxation is complex. Advisors guide investors through ownership structures, LLCs, partnerships, trusts, or REITs to maximize deductions and protect assets.

They also develop depreciation strategies, cost segregation studies, and plan exits to minimize capital gains. A well-structured tax plan ensures that investors keep more of their profits while staying compliant with regulations.

Financing and Capital Structure

Advisors design financing plans tailored to each property’s characteristics and the investor’s goals. They determine the right mix of debt and equity, evaluate interest rate exposure, and identify refinancing opportunities.

Their objective: reduce capital costs while maintaining healthy leverage and liquidity. A smart financing structure can increase portfolio returns without over-leveraging the investor.

Risk Management and Portfolio Diversification

Real estate faces cyclical, geographic, and operational risks. Advisors use diversification by asset type, geography, and time horizon to balance exposure.

They also perform scenario modeling, such as what happens if property values fall or if rental demand dips. With this foresight, they help investors design portfolios that can survive downturns and still grow during expansions.

Exit and Succession Planning

Successful investing doesn’t end with a buy; it ends with a well-timed and tax-efficient exit. Advisors help determine when and how to sell, refinance, or transfer assets.

For long-term investors, succession planning ensures property wealth passes smoothly to heirs with minimal tax friction. Advisors align exit timing with life events and market cycles for optimal results.

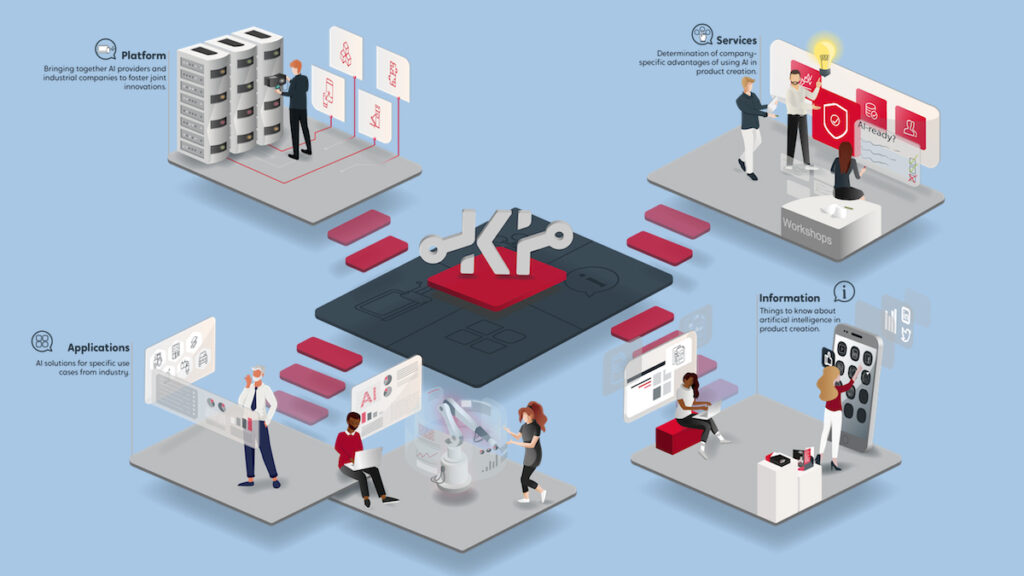

How Technology Enhances Real Estate Investment Advisory

Investment Modeling and Forecasting Platforms

Modern advisors use advanced modeling tools that replace static spreadsheets. These systems automate calculations, visualize cash flows, and simulate multiple investment scenarios instantly.

This reduces human error and allows investors to see potential outcomes clearly, leading to more confident decisions.

Market Analytics and Property Intelligence Tools

Advisors rely on data platforms that aggregate property transactions, rent indices, demographic information, and construction pipelines. These tools reveal growth patterns and help validate investment assumptions.

By combining macroeconomic data with micro-location analysis, advisors can predict where the next high-performing markets will emerge.

Portfolio Tracking and Dashboard Systems

Real-time dashboards integrate data from property managers, accountants, and lenders. Advisors use them to compare actual performance with forecasts, flagging deviations early.

If a property underperforms, they can recommend tactical fixes such as rent adjustments, renovations, or refinancing. This dynamic oversight keeps investments aligned with their targets.

Workflow Automation and Risk Simulation Tools

Automation simplifies report generation, data syncing, and portfolio monitoring, while risk simulation software runs stress tests against scenarios like rate hikes or recession shocks.

These tools empower advisors to focus less on administration and more on strategic foresight, enhancing both productivity and decision quality.

Real-World Tools and Use Cases of Real Estate Investment Advisors

Real Estate Investment Modeling Software

This software allows advisors to input data such as acquisition costs, financing terms, rental assumptions, and exit scenarios. It calculates IRR, NPV, and sensitivity outcomes.

Relevance: It helps advisors evaluate different properties side-by-side, visualize risk versus reward, and choose the most profitable options with mathematical precision.

Market Intelligence Platform

A real-time analytics dashboard showing property transactions, demographic changes, and rent growth patterns across regions.

Relevance: Advisors use this to identify markets before they peak, helping clients acquire assets while prices are still favorable. It supports data-driven market entry decisions.

Portfolio Performance Dashboard

This system integrates ongoing property performance data, actual rent collected, occupancy levels, and expenses, and compares them against projected figures.

Relevance: The dashboard gives both advisor and client continuous insight into what’s working and what needs intervention, ensuring long-term portfolio optimization.

Benefits of Hiring a Real Estate Investment Advisor

Strategic and Informed Decision-Making

Instead of relying on intuition, you benefit from sophisticated analysis grounded in data. Advisors make your investment strategy intentional and evidence-based.

Risk Mitigation and Resilience

Through diversification, scenario testing, and early warnings, advisors reduce the risk of severe losses during market fluctuations.

Capital Efficiency and Return Optimization

Advisors structure capital intelligently, minimizing the cost of funds while enhancing overall yield through leverage management and refinancing timing.

Tax and Legal Efficiency

With the right entity setup, depreciation plans, and exit strategies, investors can significantly reduce tax exposure and improve post-tax returns.

Scalability, Transparency, and Accountability

As your holdings grow, advisors and their systems scale operations efficiently. You gain full visibility and consistent reporting, enabling you to grow with control and confidence.

Real-Life Use Cases

Comparing Multiple Property Investments

An investor is torn between three cities. The advisor creates comparative models, including rent potential, tax laws, and financing costs. The analysis reveals the most profitable long-term choice, saving the investor from emotional decision-making.

Refinancing During Rising Interest Rates

With rates climbing, an investor’s loan is about to reset. The advisor evaluates partial repayment, refinancing, and variable-to-fixed options. The chosen mix protects cash flow and stabilizes returns.

Fixing Underperforming Assets

A property’s revenue falls below forecast. The advisor analyzes the issue, rents too low, maintenance too high, or wrong tenant mi,x and suggests corrective actions like repositioning or targeted upgrades. Performance rebounds within months.

Exit and Wealth Transfer Strategy

A retiree wants to liquidate assets gradually. The advisor structures sales timing and entity transfers to minimize tax. The investor gains liquidity while preserving family wealth through trusts.

Challenges and Things to Watch Out For

Dependence on Market Assumptions

If core assumptions rent growth, demand, or cost inflation are off, results diverge. Advisors must continuously update models with fresh data.

Complexity and Overanalysis

Overly detailed scenarios can overwhelm clients. Good advisors simplify without oversimplifying—turning data into clear action steps.

Regulatory or Tax Changes

Markets evolve. Tax or policy shifts can disrupt even solid plans, requiring advisors to stay informed and agile.

Conflicts of Interest and Cost-Benefit Balance

If advisors earn commissions on property transactions, transparency is key. For smaller portfolios, fees must be proportional to value added.

How to Choose the Right Real Estate Investment Advisor

Experience and Track Record

Look for proven experience across various property cycles and references from prior clients.

Financial and Analytical Skills

They should demonstrate mastery of modeling, portfolio design, and quantitative analysis.

Communication and Transparency

They must explain strategies clearly, report performance regularly, and disclose all conflicts.

Technology Adoption and Independence

Ensure they use modern analytical tools and operate independently, not tied to selling specific properties or products.

Frequently Asked Questions (FAQ)

Q1: Do I need a real estate investment advisor for small portfolios?

A1: Yes. Even smaller investors benefit from professional insight. Advisors can tailor their service scope to match your portfolio size and complexity.

Q2: How do advisors charge for their services?

A2: Fee structures vary; some charge fixed project fees, retainers, or a percentage of assets advised. The best models align advisor success with client returns.

Q3: Can a real estate agent replace an investment advisor?

A3: No. Real estate agents handle transactions, while investment advisors provide strategic, long-term financial planning across properties. Both roles complement each other but serve distinct purposes.