Understanding CrowdStreet Investments Platform, Risks & Rewards

CrowdStreet investments refer to the suite of private commercial real estate opportunities made available through the CrowdStreet platform. These opportunities allow accredited investors to allocate capital into real estate projects, funds, or debt structures, rather than relying only on public REITs or stocks. Understanding how CrowdStreet investments work, what drives their returns, and how to evaluate them is essential for anyone considering this space.

In this article, you will learn:

-

The mechanics behind CrowdStreet investments

-

Deal structures and capital stack variations

-

Real-world example use cases

-

The benefits of technology in facilitating these investments

-

Use case scenarios for different investor goals

-

Risks, best practices, and evaluation criteria

-

Three frequently asked questions with detailed answers

By the end, you’ll be equipped with the depth to assess whether CrowdStreet investments are suitable for your portfolio and how to navigate their nuances.

Mechanics: How CrowdStreet Investments Work

CrowdStreet presents curated commercial real estate (CRE) deals to accredited investors. These deals often involve sponsors (developers or operators) who propose projects needing equity or debt capital. The platform conducts vetting, documentation, capital raising, investor onboarding, and performance reporting.

When you invest via CrowdStreet, you usually go through the following steps:

-

Review offering materials: business plan, financial model, risk disclosures, capital stack.

-

Commit capital: you sign subscription documents, verify accreditation, and your funds go into an escrow account.

-

Funding and deployment: once the raise meets conditions, capital is released to the project sponsor.

-

Distributions & oversight: as the property generates cash flow or reaches milestones, investors receive periodic distributions. The platform provides updates, financials, and asset performance tracking.

-

Exit event: after a certain hold period, the project exits via sale, refinancing, or recapitalization. Capital plus profit is returned per the waterfall.

Because CrowdStreet focuses on private and institutional-style deals, liquidity is limited; these are long-term commitments usually locked for several years. Also, returns depend not only on cash flow but on value appreciation and execution by the sponsor.

CrowdStreet also offers funds or pooled vehicles in addition to single-asset deals. These provide diversification across multiple projects while still leveraging the same backend platform for subscription, reporting, and capital management.

CrowdStreet’s own site indicates that over 800 projects have been launched to date across a variety of asset types. crowdstreet.com The platform further emphasizes that investors benefit from both ongoing cash distributions and a share in the property’s final sale proceeds.

Deal Types & Capital Structure in CrowdStreet Investments

Not all CrowdStreet investments are structured identically. The platform supports different deal types and capital structure allocations based on risk, returns, and investor preferences.

Equity Deals (Common Equity):

These are traditional deals where investors share in rental income (less expenses and debt service) during the hold period, and later share in capital appreciation at the exit. Equity deals often carry higher upside but also higher risk if leasing, cost control, or market conditions go poorly.

Preferred Equity / Mezzanine / Debt Offers:

In some cases, investors may be offered preferred equity, mezzanine positions, or debt tranches. These are more structured investments, where investors receive fixed or preferred returns before equity investors. They usually enjoy more downside protection but limited upside compared to pure equity.

Fund or Pooled Investment Vehicles:

CrowdStreet offers fund-level investments, where capital is pooled across multiple properties or project types. This structure reduces risk concentration while still offering exposure to the real estate market. Funds may include commercial, multifamily, industrial, or mixed-use assets.

Capital Stack Layers:

Every project has a capital stack: senior debt, subordinate debt, preferred equity, and common equity. How returns flow depends on the waterfall structure, prioritized payments, promotion (profit share) on excess returns, and hurdle rates. Investors should understand where in the stack their investment sits.

Because CrowdStreet invests in private equity real estate rather than public REITs, value is often driven by property-level dynamics (rents, occupancy, cap rate compression), not market sentiment.

Real-World Example Use Cases of CrowdStreet Investments

Below are three illustrative examples of different types of CrowdStreet investments, each highlighting unique features and challenges.

Example 1: Value-Add Office Renovation

In a value-add office deal, a sponsor acquires an older office building with vacancy and leases below market rates. The business plan includes capital renovations, rebranding, tenant improvements, and an aggressive leasing strategy. The hold period may be 5–7 years.

Investors receive distributions once stabilization occurs. After exit, investors share in the profit from appreciation. Sensitivity analyses often consider downside lease rates, vacancy, and exit cap rate compression.

This kind of investment is relevant because many CrowdStreet offerings use a value-add strategy to generate outsized returns over the hold period, especially in markets with rental growth potential.

Example 2: Preferred Equity in Multifamily Development

A developer plans to build or expand a multifamily complex in a growing metro. Instead of taking on all equity risk, they offer preferred equity to investors. In this structure, preferred equity investors receive a predetermined return (say 8–10%) before common equity participates in upside.

Preferred equity deals may limit participation in capital appreciation, but they protect investors in the downside, making them attractive to those seeking reliable income with moderated risk.

Example 3: Diversified Real Estate Fund Across Property Types

CrowdStreet may issue a fund that pools several properties across different asset classes and geographies. The sponsor manages the portfolio, spreads risk, and allocates capital among the best opportunities.

Investors benefit from reduced exposure to any single property’s failure. The fund structure allows exposure to multiple markets, easing concentration risk.

These real-world examples show how CrowdStreet investments span aggressive, moderate, and diversified approaches, each with distinct risk/return trade-offs.

Benefits of Technology in Facilitating CrowdStreet Investments

Technology is foundational to CrowdStreet’s model. Without the platform’s digital infrastructure, scaling private real estate investing for individual accredited investors would be impractical.

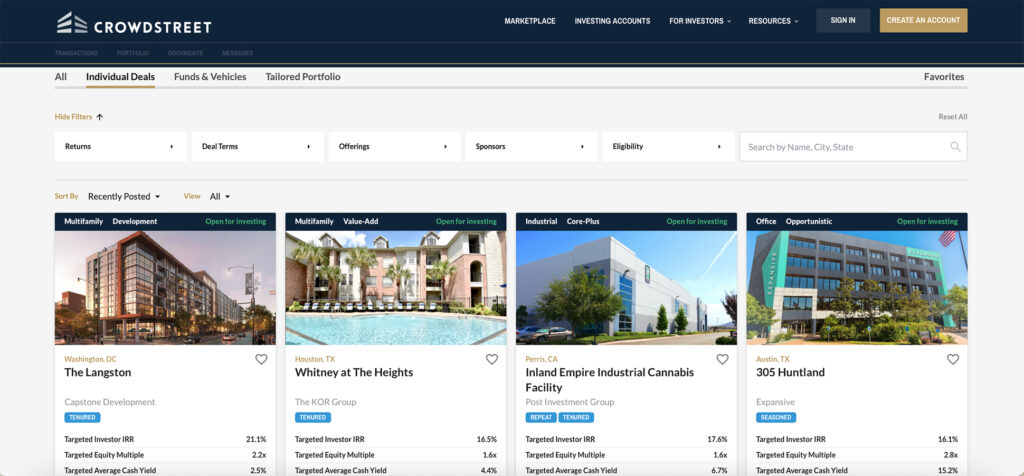

Deal Discovery & Filtering:

Investors can browse, filter, and compare deals by property type, geography, return targets, risk profile, and minimum investment. This improves accessibility and control over portfolio selection.

Underwriting Tools & Transparency:

Interactive dashboards, financial models, scenario stress tests, market comps, and assumption breakdowns allow investors to interrogate deals thoroughly. This removes some informational asymmetry.

Automated Subscription & Compliance:

Accreditation checks, KYC/AML validation, subscription document signing, escrow handling, and fund disbursement are automated. This streamlines onboarding and reduces manual risk.

Real-Time Reporting & Updates:

Investors can monitor performance, capital calls, distributions, and sponsor reports through the platform. They receive timely updates without manual follow-up.

Scalability & Efficiency:

The technology stack allows CrowdStreet to list many deals and manage many investors in parallel without linearly increasing administrative costs. This helps maintain cost efficiency and consistency.

These advantages transform what once was a niche institutional process into a more accessible, transparent, and scalable investment experience.

Use Cases: What Problems CrowdStreet Investments Solve & How They Help Investors

Use Case 1: Institutional-Quality CRE for Accredited Investors

Many individual investors lack access to high-quality commercial real estate sponsors or syndications. CrowdStreet investments democratize access: sophisticated deals with vetted sponsors become available to a wider set of accredited investors.

This addresses the gain of deal flow and execution burden for individual investors.

Use Case 2: Diversification Beyond Public Markets

Investors heavily exposed to public equities or bonds often seek alternative asset classes. CrowdStreet investments offer real estate exposure with different risk drivers rent growth, local market cycles, and property operations, helping diversify correlation risk.

Thus, it solves the problem of overconcentration in liquid markets.

Use Case 3: Passive Real Estate Income Without Management Burden

Investing directly in rental properties requires hands-on management, tenant issues, repairs, and financing. With CrowdStreet, investors select deals and remain passive. The sponsor handles day-to-day operations, leasing, improvements, and exit execution.

This solves the operational burden of being a landlord.

Use Case 4: Tactical Exposure to Growth Markets & Asset Types

CrowdStreet investments allow investors to pick deals in high-growth sectors (industrial, medical office, logistics) or geographic expansion zones without needing local knowledge. You can invest in trends identified by sponsors.

This solves the challenge of accessing specialized or niche property opportunities.

Use Case 5: Scaling Real Estate Allocation Efficiently

When you have capital to deploy but don’t want to source multiple sponsors independently, CrowdStreet investments provide a unified interface to evaluate, commit to, and monitor multiple deals efficiently. This aggregation solves the scaling challenge in private real estate investing.

Risks, Challenges & Best Practices

While compelling, CrowdStreet investments carry significant risks. Awareness and mitigations are essential.

Illiquidity & Long Holding Periods:

Most deals lock capital for 3–7+ years. There is rarely a secondary market, so exit flexibility is limited.

Sponsor Risk:

Project performance depends heavily on sponsor execution, leasing, renovation, cost control, a n debt management.

Market & Macro Risk:

Interest rates, vacancy cycles, property market corrections, and economic downturns can erode value or cash flow.

Assumption Sensitivity:

Aggressive assumptions about rent growth, exit cap rates, or expense control may fail in practice.

Fee Structure Complexity:

While CrowdStreet may not directly charge investors in many cases, sponsor fees, acquisition charges, asset management fees, and profit-sharing (promote) reduce net investor returns.

Deal Concentration Risk:

Putting too much capital into one or a few deals increases the impact of any underperformance.

Regulatory & Policy Risk:

Changes to tax law, securities regulation, or real estate rules can affect investment returns or deal structure.

Selection Bias & Survivorship Bias:

The marketing and realized deals often highlight successes; failed deals may be underreported.

Due Diligence is Non-Optional:

Even though CrowdStreet vets deals, investors must still dig into assumptions, stress test models, understand exit plans, and evaluate the sponsor’s track record.

To manage these, adopt best practices:

-

Review offering documents deeply and stress-test scenarios.

-

Check sponsor history, reliability, and communication.

-

Diversify across property types, geographies, and risk levels.

-

Track performance vs pro forma projections and revisit assumptions.

-

Plan capital with a long horizon, without needing early liquidity.

-

Beware of deals with overly optimistic projections or limited downside disclosures.

FAQ

Q1. Who is eligible to invest in CrowdStreet investments?

These opportunities are typically open only to accredited investors, as defined under U.S. securities law (e.g., net worth, income thresholds). Minimum investment amounts often range from tens of thousands of dollars.

Q2. How do I receive returns, and when?

Returns often come in two ways: periodic cash distributions from operations (rent minus expenses) and capital gains from property appreciation at exit. Distributions may occur quarterly or semiannually, while exit returns happen upon sale or refinancing after the hold period.

Q3. Can I exit early before the investment term ends?

Generally, no. CrowdStreet investments are illiquid, and early exit is typically not supported or may incur penalties. Investors should plan to commit capital for the full projected term unless specific exit options are stipulated in the deal documents.